Insurance Basics for Construction Professionals - by Pete Fowler. Originally published by The Journal of Light Construction in 2021

In Construction, a Good Broker May be More Valuable Than a Lawyer

If you are a construction professional, you are at risk, and every step of every job presents risk that has the potential to bring harm—be it financial or bodily—to yourself, your loved ones, your staff, your clients, and the public. Insurance can cover this risk, but you must not do this alone. If you don’t consider your insurance broker a key advisor, read this article and then go shopping for an insurance broker who can help you understand what you need to do to protect yourself and your business.

For the last 20 years, my company—a construction services firm conducting traditional building inspection and testing, estimating, quality assurance, and construction management services—has worked on hundreds of building claims and litigation matters, including expert witness testimony. We have been hired to analyze the liability of thousands of project players. These are examples of some cases we have worked on:

A general contractor performed a whole-house interior and exterior remodel, using more than a dozen subcontractors. The owners were dissatisfied and refused to make the final payment, so the general contractor sued the owners. In response, the owners hired a lawyer and a team of experts to examine the project and find every conceivable variation from perfection, and sued the general contractor for construction defects, claiming a cost to repair of more than 100% of the original contract price. The general contractor, in turn, sued every subcontractor who worked on the elements of work in the defect claim. We have worked on so many of these cases, the sequence of events is like a proverb.

A condominium owner hired a general contractor for an interior remodel. The general contractor hired a plumbing subcontractor who was using a torch and lit the building on fire. The condominium association’s insurance company paid to make repairs to the common area, and then pursued both the general contractor and the plumbing subcontractor for reimbursement of the claim paid.

An employee of a scaffolding sub-subcontractor, hired by the siding subcontractor, fell and was gravely injured. Since the employer had the required workers’ compensation insurance, the injured worker was unable to sue his employer, but he was not prohibited from suing the siding subcontractor who hired his company and the general contractor. The general contractor’s insurance company hired a lawyer, who hired us to investigate and explain the roles and responsibilities of the various parties, in sworn testimony.

Count yourself lucky if you haven’t been involved in a similar case. But even if you have escaped this misery, you need to ask yourself now, What would I do, if I were a player in one of these scenarios? More importantly, you need to be insured for any of these scenarios. It’s not a matter of “if” anymore, it’s “when.”

In this article, I’ll go over the basics so you have some background to ask the right questions when shopping for an insurance broker, as that’s what you need to do if you don’t already have one who is looking out for your interests.

Toward a Risk Management Plan

As a construction professional, you’re in the business of risk management. Now, let me be clear: Risk management is an enormous topic. It can be an entire profession, so a one-minute summary here won’t begin to explain all that you need to know ... but it’s important that you begin to think about being prepared to do exactly what the term says: manage, not just take, risks.

Risk management is the process for identifying, assessing, and prioritizing risks so they can be understood and addressed proactively. Risks in construction are immense; they range from something like fire, or a fall causing an injury, to a construction defect lawsuit.

Risk management allows businesses to understand and prepare for the unexpected by avoiding problem situations or minimizing risks and planning for extra costs before they happen. Every business faces the risk of unexpected, harmful events that can cost the company money, or even bankrupt the owners and business. There is no way to avoid risk entirely. But being aware and prepared with a thoughtful risk management plan can not only save businesses money, it can protect a company’s public image, while potentially preventing injuries and accidents by keeping safety top of mind. Most risk management strategies include the use of insurance.

Types of Insurance

All professional business owners and managers should know the options and requirements for different types of insurance. Sure, there are people like agents and brokers who will help businesses find and decide on policies, but having a big-picture understanding of these common types of insurance is helpful in making wise decisions. The business owner or manager has to make a judgment about how much insurance to carry based on their “risk tolerance.” Here’s a summary of the most common types of insurance in our industry.

Workers’ compensation insurance, also known as workers’ comp, is a type of business insurance that provides benefits to employees when they suffer from work-related injuries or illnesses. This insurance will help cover missed wages, medical expenses, vocational rehab, and death benefits from a compensable workplace injury to a covered employee. It not only helps employees but also protects businesses from lawsuits and keeps businesses compliant with state regulations. Generally, if an employee is entitled to workers’ comp, they can not make a claim against their employer.

Nearly every type of employer in all states in this country is required to have workers’ compensation insurance. Some states even have laws that require general contractors to actively make sure and document that every person on site, including the employees of subcontractors, are covered by a workers’ comp policy.

Commercial general liability (CGL) insurance provides coverage to a business for bodily injury, personal injury, and property damage caused by the business’ operations, products, or injuries that occur on the business’ premises or work sites. Commercial general liability can help protect a business from losses due to third-party bodily injuries, third-party property damage, reputational harm like libel and slander, and advertising injury (when another business claims your advertising looks too much like theirs). This type of insurance can help cover the cost of legal teams to represent your business, witness fees, evidence costs, judgments, or settlements. These policies are not for professional errors or omissions, only for “resulting or consequential damages” to the property or people, which includes claims like costs for lost profits and revenue. It is not required by law for all businesses to carry this type of insurance, but many administrative rules by state agencies overseeing the construction industry require construction contractors to have CGL insurance.

Builders risk is a special property insurance that covers damage to a construction project during the course of construction. Because every construction project is different, no two builders risk policies are alike. Generally, most builders risk policies cover property losses due to fire, lightning, hail, explosions, hurricanes, theft, vandalism, and many other risks. Exact coverages and limitations can vary greatly depending on the provider, and additional coverages can be added for extra expense, such as delay in opening, soft costs, extra expense, and loss of rents.

Umbrella coverage is a form of supplemental liability insurance. It protects the insured against claims that go beyond the existing limits of their other insurance policies, in particular CGL, auto liability, and employers’ liability section of a workers’ compensation policy. These policies usually do not pay until all other policies have been exhausted. An umbrella policy is not the same as an excess policy, but the differences are far beyond the scope of this article.

Errors & omissions (E&O) insurance is professional liability insurance. This coverage is to protect companies and workers from lawsuits that claim mistakes were made in delivering professional services or inadequate work. It is designed to help protect businesses from negligence, errors, omissions, misrepresentation, violations of good faith, inaccurate advice, and injuries like libel and slander. It can help cover court costs, attorney fees, administrative costs to build a defense, and settlements. Architects, engineers, doctors, lawyers, and other licensed or registered professionals can buy these policies. In general, these policies are not available to construction contractors unless they are doing design work, in which case they can purchase contractor’s professional liability insurance to cover professional services such as value engineering, schedule coordination, and design-build services.

Wrap up insurance is a method of insuring multiple parties (typically, owner, contractor, and all subcontractors) participating in multimillion dollar projects to ensure they all have the same broad coverage, limits, and claim response. There are two types of wrap up insurance: owner controlled and contractor controlled.

The owner-controlled variety is set up by the owner of a project to benefit the builder or contractor and covers all listed contractors. Contractor controlled is set up by a general contractor to extend coverage to all contractors and subcontractors. The structures of wrap up programs vary widely, but they almost always cover general liability and umbrella liability for all contractors participating at the project site. They can also include workers’ compensation, builders risk, pollution liability, and professional liability. While wrap up insurance programs are most frequently used for large, single-site projects, a blanket or rolling wrap up can be used to insure multiple projects under one program. These policies have become popular in development projects, in part because common CGL policies typically exclude work on certain types of projects, including multifamily, that are common targets for construction defect litigation.

Conflict during construction defect claims is quite common, so successful wrap up policies are possible only when the insurers, sponsors, and participants recognize the value of a group approach and commitment from all concerned. This often requires a more cooperative approach to claims than the parties may be used to. Without such cooperation, the parties involved are back to only individual policies and adversarial claims.

Self insurance is a system in which a person or business sets aside an amount of money to cover any losses that may occur. When people or businesses consider losses they can afford to cover, self insurance may save money since they won’t be paying a premium. This route requires retention at their own cost instead of having it insured.

No insurance is when a business refrains entirely from insuring against risks.

Roles and Responsibilities

Making an informed decision with the help of a trusted and super- knowledgeable advisor is the right thing to do; making your own decision based on your own knowledge and experience is unwise. Everyone has a role to play when it comes to insurance. Here are the basics.

Insured. The insured is the person or company (contractor, designer, and such) covered by the insurance policy and is usually the one who paid “the premium” (the cost of the insurance). The insured’s responsibilities begin with choosing and securing the right advisors. There is plenty of variation in coverage and policies, each of which may have its own definition of the insured’s duties. These should be thoughtfully reviewed, as a breach of these duties is a breach of contract. A thorough understanding of the policy and what is expected is a critical first step. Most of these duties will include notifying the insurer of a loss or claim, or even a situation that may result in a claim. Responsibilities can also include honesty and cooperation with the insurer throughout the investigation process and proof of loss. In the same way that construction professionals should read work contracts they sign, they should sit down and read the insurance contract. If the insured is also the policyholder, it is their duty to pay the policy premium.

Agent. Agents act as the go-between for the insured and insurance companies. Agents specifically act as representatives of insurance companies. They sell policies on behalf of insurers and may work for a single company, or they may be independent and represent multiple companies.

Broker. Brokers represent the insured. They do not work for insurers directly; rather, they solicit quotes or policies from insurers on behalf of the insured. Construction is a risky business and a good argument could be made that a great insurance broker is more important than a great lawyer.

Underwriter. Underwriters approve or renew applications for insurance coverage for individuals and businesses. They evaluate and assume the risk of future events and charge premiums in return for a promise to reimburse the insured party in the event damage occurs. Underwriters typically work for the insurance company.

Insurance company. Insurance companies offer risk management in the form of insurance contracts. When they receive an application for a policy, they look at the perceived risk and decide whether the policy will be issued or denied. If the policy is issued, the insurance company or insurer guarantees payment for an uncertain future event.

Attorney. Finding a great attorney using basic due diligence is a must for business success. They are like a priest to whom you confess your sins, and they are like a wonderful mentor you can call when you’re not sure of yourself. A lawyer experienced in your type of business should be on retainer, and you should call and ask them questions at least a couple of times a year.

Coverage Basics

There are few hard and fast rules, so anyone who thinks they know what is covered and what is not without reading the text of the policy is foolish. Even when you have read the policy, you still don’t know for sure. The arguments are so nuanced and the language so arcane that we sometimes don’t know for sure until a judge or jury tells us what’s covered.

Contractual risk transfer. Contractual risk transfer is a non-insurance contract or agreement between two parties where one agrees to hold another party harmless for specific actions, inactions, injuries, or damages. The ideal use of contractual risk transfer is to place the financial burden of a loss on the party best able to control or prevent the incident leading to injury or damage. These contracts should be as specific as possible, detailing scope of work and any financial burden should loss occur. They are accomplished using indemnity agreements, additional insured endorsements, and subrogation waivers (refer back to “Types of Coverage,” above). The most common example of a contractual risk transfer in construction is an indemnity agreement as a clause in prime subcontracts.

Indemnity agreements. Indemnity is a contractual agreement between two parties where one party agrees to pay for potential losses or damages suffered by the other party that arise from the first party’s performance of work as required by the contract. These can be seen in many insurance contracts where the insurer (or the indemnitor) agrees to pay the insured (or the indemnitee) for any damages or losses in return for premiums paid by the insured. When the term indemnity is used in the legal sense, it may also refer to an exemption from liability for damages. These agreements have what is called a period of indemnity, which is a specific length of time for which the payment is valid. Many contracts also include a letter of indemnity, which guarantees that both parties will meet the contract stipulations or an indemnity must be paid. All of the most sophisticated construction contracting businesses have well-defined standards around the issue of indemnity agreements. In general, lower-tier contractors, like subcontractors, indemnify the general contractor for any harm the subcontractor might cause.

Certificate of insurance (COI). A certificate of insurance is nothing more than a piece of paper showing proof of insurance, policy limits, and a coverage period at that point in time. Simply put, it is a contractor’s way of showing an owner or another party they have insurance. The policyholder has their agent issue a certificate of insurance to prove they have an active policy at the time the certificate is created. For example, the general contractor on a project may ask for proof of insurance from the subcontractor. The subcontractor would obtain a certificate of insurance. This certificate might name the general contractor as the “Certificate Holder,” but that does not mean they are included in the policy. All that means is they are the one receiving the document.

Additional insured (AI) endorsements. Many contracts require the policyholder to extend their coverage to other entities. Anyone who benefits from this extension of coverage is an “Additional Insured.” If you are the general contractor, having your company become an additional insured means the subcontractor’s policy also has your company covered. If they cause a loss, their insurance policy will be the first to pay for the claim.

Certificate and additional insured best practices include the following steps:

Step 1. Determine who manages certificates and how records are maintained.

Step 2. Develop an internal waiver process when accepting noncompliance for lower-risk trades.

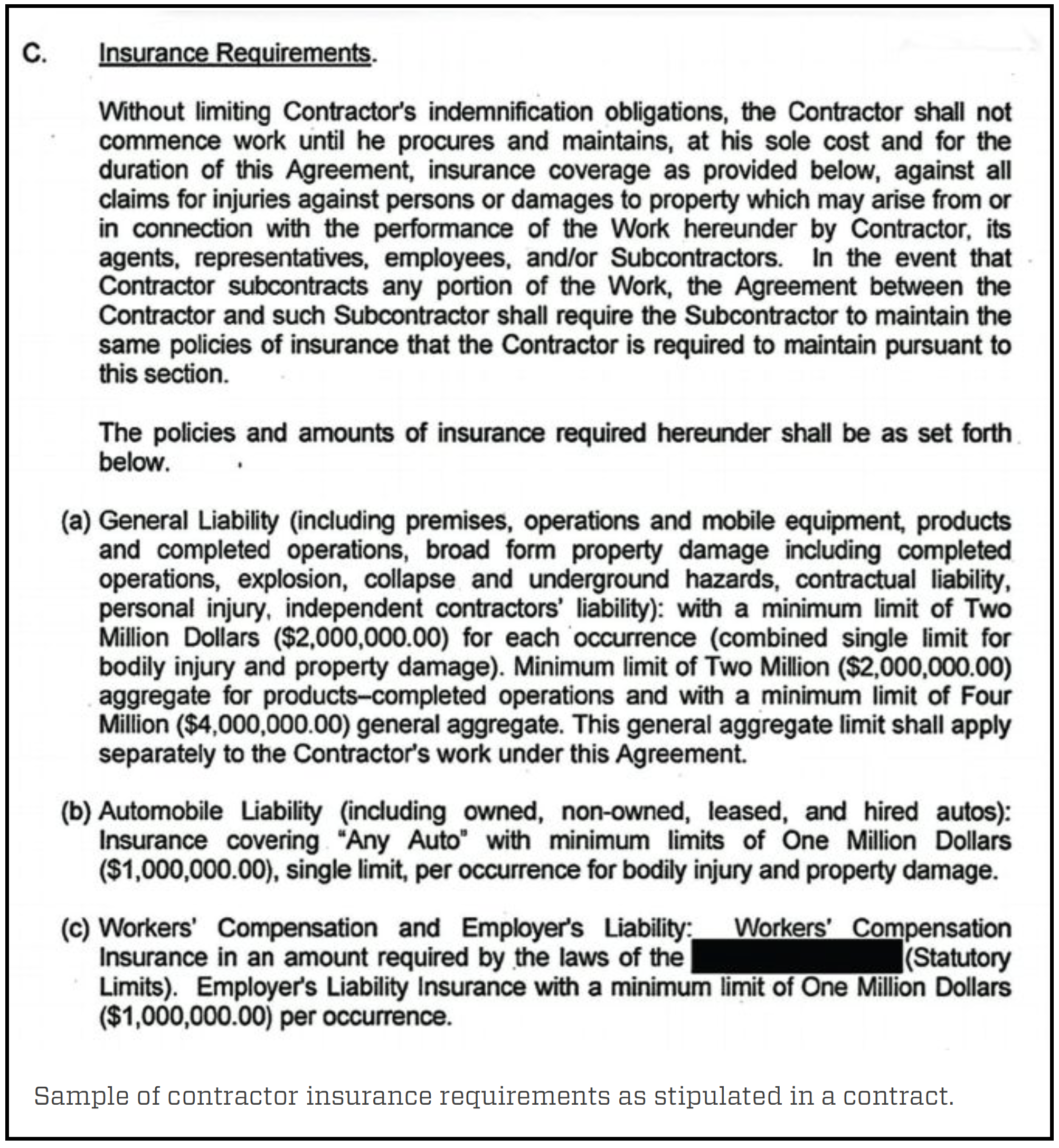

Step 3. Develop clear insurance requirements in contract and subcontract agreements.

Step 4. Make compliance mandatory for high-risk sub-trades, like waterproofing or roofing, with a waiver process for lower-risk trades.

Step 5. Keep copies of all documents in a subcontract file. Make sure to get renewal certificates and additional insured (AI) endorsements.

Step 6. Consider specialized certificate or management software to make 100% sure that 100% of the certificates you care about are correct.

Waiver of subrogation. When an insurance company pays a claim, it often investigates the possibility of recouping what was paid if the loss was caused by someone else. The recouping of insurance claims paid is called “subrogation.” If there is another party directly involved in the claim, or that the insurance company can prove shares responsibility for the loss, the insurance company will initiate subrogation against that other party to recover what was paid to the insured. The most common type of claim that can be subrogated is property damage.

A waiver of subrogation is when two parties contractually agree to waive rights of subrogation either against one of them or against each other (mutual waiver). Insurance companies do not automatically follow contractual subrogation waivers but will usually agree to follow the contractual waiver for an additional premium. For example, say the owner of a building has hired a contractor. Property damage to the building occurs during a storm and the owner’s insurer pays the claim to make repairs. If no waiver of subrogation was included in the policy, the insurer is free to pursue the contractor. If the insurer can provide enough evidence, the contractor may become responsible for the financial burden of the property damage. The addition of these waivers generally results in a premium increase, but they can save the time and cost of lawsuits, cross-suits, or countersuits.

“Your Work” exclusion. Most CGL policies will include a “Your Work” exclusion. This type of exclusion, in its most basic form, means that the policy will not cover damages to a structure built by an insured contractor. Since a contractor controls the quality of their own work, it has been determined that it is fair to hold them accountable if the work is faulty. Faulty work can include parts, materials, equipment, or any type of operation performed that is done incorrectly as part of the work. This could be repairs or maintenance that doesn’t meet the standards of quality, representations, or warranties. Faulty work can also include a lack of warnings or instructions. While the policy will cover most damages as a result of faulty work if they occur during the policy period, it will not cover the loss of correcting the work or repairs to fix the problem that caused the damage. For example, a roofing contractor does bad work. The contractor’s insurance company will pay for resulting damages of a roof leak, like drywall or carpet, but won’t pay for the cost to repair the roof. There can be many specific scenarios included in a “Your Work” exclusion, so paying careful attention to details is important.

Consequential damages are indirect damages associated with a breach of contract. Direct damages from a roof leak, for example, would be drywall and paint. Indirect damages can include lost profits, loss of the use of a building, loss of rent, increasing financing costs, damage to a business’s reputation, or loss of opportunities.

Dangerous Business

Regardless of who you are in the construction industry, you are at risk of a claim. It’s a dangerous business. That is part of what makes it interesting, but you need to be ready to survive whatever is likely to come your way.

In the three scenarios I presented in the introduction, none of the general contractors was forced out of business, because they were insured. In two out of three, the legal and expert fees alone were hundreds of thousands of dollars, and the settlements were many times that. In the third situation, legal and expert fees were more modest, but the cost to repair the physical damage was hundreds of thousands of dollars.

Hopefully, those are convincing outcomes to inspire you to go find a good insurance broker and use this article as a checklist to have them explain how all of this applies to you, your work, and your business specifically.

Pete Fowler is president of Pete Fowler Construction Services (www.petefowler.com), which provides building inspection and testing, estimating, quality assurance, and construction management, as well as claims and litigation support, throughout the U.S.